I once again wish to acknowledge the continued contribution of our front line workers, to the protection and support of our community in the face of this unrelenting pandemic.

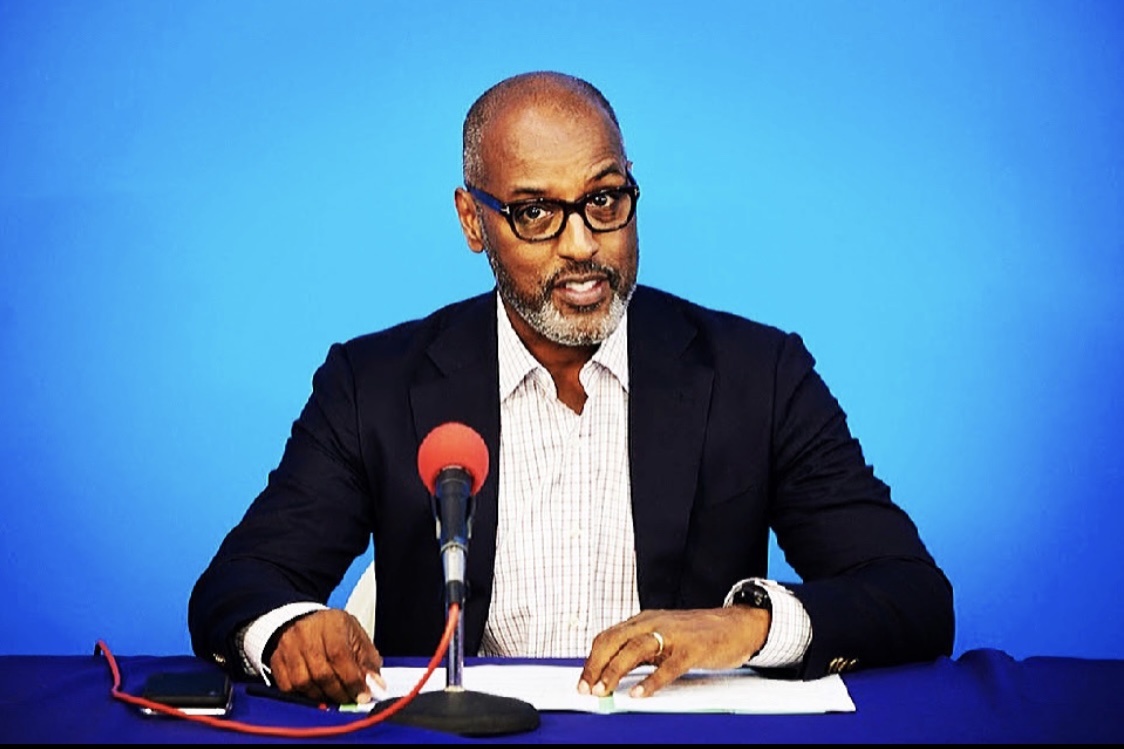

My remarks are to provide some brief context on certain initiatives highlighted in last week’s Throne Speech that directly involve the Ministry of Finance.

Pension Fees

In a Ministerial Statement on 10 September 2021, I provided an update on progress made to enhance the conduct framework for the financial services sector in Bermuda. The objective is to provide additional requirements regarding the conduct of institutions and the protection of customers. This will be achieved with amendments to the Bank and Deposit Companies Act 1999 that provide additional powers to the Bermuda Monetary Authority to allow them to adopt and enforce clear and consistent regulatory processes.

Last week’s Throne Speech identified another initiative relating to private pension plans, or more specifically, private defined contribution plans. These are the pensions most employees in the private sector have in Bermuda, where periodic payments are made into the plan by the employee and/or their employer.

In these plans, the retirement income that a plan participant receives, upon retirement, depends on how much is paid in and how it is invested over time (i.e. rather than a formula based on number of years with your employer). Therefore, the return on the investments that are achieved by an individual participant’s plan is a critical factor in the affordability of their retirement.

However, the return that a participant receives is after all fees have been paid. This may include management fees and expenses charged by fund managers, but also includes fees charged by service providers, such as administrators, trustees and custodians. Often the breakdown of these fees is not easily discernable. More importantly, many people do not understand the impact that the size of the fee makes on their future income potential.

Transparency and investor education related to this area should therefore form part of any financial conduct regime.

In fact, a small increase in return (i.e. resulting from a small cost saving) can have a very meaningful impact on future retirement income, especially over longer periods of time that funds are invested. Therefore, we will undertake an assessment, involving all stakeholders, to ascertain whether there are opportunities to lower costs to plan participants.

Thus far I have discussed our work to strengthen frameworks relating to local financial institutions which impact their clients. The Ministry of Finance is also committed to conduct and oversight within the Government and related entities that impacts the public at large.

Service on Boards and Quangos

As mentioned in the Throne Speech, service on Government boards and quangos has become more complex, as these bodies are delegated powers, and independently perform functions under various statutes but on behalf of the public.

The Ministry of Finance will continue its work to strengthen financial oversight and governance arrangements. As part of this work, we will be reviewing the requirements for all boards and quangos under our purview, to ensure that experience criteria are appropriate,, and that persons appointed are equipped to carry out their responsibilities. Where necessary, this will involve mandatory fiduciary training or professional accreditation in disciplines, such as legal, financial or accounting, and may be mandated through legislation as necessary.

In addition, as part of the reviews, the Ministry of Finance will also assess governance procedures and financial controls in place to ensure that they appropriately conform to best practices.

Reviews will also be extended to other entities for which the Ministry of Finance is required to give approval of budgets and work plans. It will also include any entities where the Government is deemed to have a significant financial interest or exposure.

Tynes Bay

Finally, I would like to provide brief comments that address the important issues highlighted by Minister Furbert’s remarks regarding Tynes Bay.

As you can imagine, any proposed replacement or refurbishment of our waste to energy plant is a large project. It will also involve a sizable financing requirement. In addition, we recongnise there is an imminent need to take action, and that Tynes Bay forms part of an even larger Water and Wastewater Master Plan, which requires an even greater level of financing.

Consequently, and in parallel with the work being carried out to assess options for the physical infrastructure, we are assessing potential financing structures that must form part of an overall business plan that is financially prudent. As there are real risks of potential failures at Tyne’s Bay, not to mention mounting maintenance and repair costs, we will work diligently to execute on the most optimal plan for the long term, which will balance securing the country’s infrastructure requirements with continued financial prudence.

We look forward to working together to address all of these issues, which in our view are important to the health and well-being of our community.

————————————————————————————————Any content which is considered unsuitable, unlawful, or offensive, includes personal details, advertises or promotes products, services or websites, or repeats previous comments will be removed.

User comments posted on this website are solely the views and opinions of the comment writer and are not a representation of or reflection of the opinions of TNN or its staff.

TNN reserves the right to remove, edit or censor any comments.

TNN accepts no liability and will not be held accountable for the comments made by users.